Information In Safe Hands

Choice of Interest Rates

Expert Relationship Managers

What are equity release mortgages?

When you borrow additional funds through mortgage using the equity of a property or home, it is called equity release mortgage. You encash the value of the percentage of the house left after paying a considerable part of the mortgage on it. It is an affordable and popular way to handle the expenses and take the actual value of hard-earned money through your home.

How does equity release work?

Equity release lets you borrow money equivalent to the property value after reducing the mortgage amount that you have paid. Here is an example to explain the concept of how to release equity on your home? A simple calculation below will describe the way things work.

- The current value of your home is - £350,000

- The mortgage you have paid on the house is - £200,000

- The equity that you have earned will be – Paid Mortgage subtracted from House Value, i.e. £200,000 – £3,50,000 = 1,50,000

You borrow money tax-free through equity release

Shine Mortgages arranges a wide choice of equity release interest rates, as we bargain with the lenders to bring you the best possible deal that duplicates your financial requirements.

Types of equity release mortgages

Equity release mortgages are not about only one product; they are about the several financial products that facilitate the release of the actual value on your home.

The most common types of equity release plans are –

- Lifetime mortgage

- Home reversion

One by one description of both can help understand the available options.

1) Lifetime mortgages – This product is used by older adults to borrow money, and they do not need to pay off until their death or move to permanent/long-term care. The percentage of equity that one wants to encash depends on the borrower. If he wants to keep some for an inheritance, he can do that. When it happens, the house is sold to pay off the loan. The borrower does not need to pay off the borrowed money because it is something that belongs to him only. It is the value earned as the result of the mortgage paid on the property. However, interest is charged on the borrowed amount, but it gets added to the total mortgage amount.

There are two types of lifetime mortgages –

- Interest roll-up mortgages – You get money either in a lump sum or in regular amounts and an interest rate is charged on it. The amount due on the interest will be paid at the term-end when your house is sold to pay off the loan. According to the nature of the lifetime mortgage, the amount is paid off at the end.

- Interest paying mortgage – You get a lump sum amount (not in recurring paid funds), and he makes payments on a monthly basis. Some interest-paying mortgage providers also let you pay the capital. Otherwise, the borrowed money is paid off at the end of the loan term.

Are equity release products regulated?

Yes, the equity release products are regulated and controlled by the regulatory authorities and the rights of the borrowers are secured. In fact, 95% of this industry is regulated.

2) Home reversion – Home reversion is a type of equity release in which one sells the complete house or a part of it to a private company. In exchange, he can live there whole life without paying any rent. This method is quite popular in the UK, and every year numerous people obtain funds through it. Usually, the aged people go for a home reversion plan to pay for their care. According to age or medical conditions, one can borrow more funds.

Terms & Conditions For Lifetime Equity Release And Home Reversion Equity Release Plan

Before you make any choice on lifetime equity release and home reversion equity release mortgage, know about the qualifying terms and conditions. Both the equity release options have different features and conditions. Your application for any of these needs to be prepared accordingly, and the management of finances changes in accordance.

| TERMS AND CONDITIONS | |

|---|---|

| Lifetime Equity Release | Home Reversion Equity Release |

| The minimum age (usually) to take out this mortgage is 55. | The minimum age for home reversion is 60 or 65 before applying for the plan. |

| You can borrow up to 60% of the property of the current value. But age is a significant factor. | You sell a complete house or a part of it. If some mortgage amount is due, you cannot sell the full share. |

| Rate of interest is usually fixed, and in case it is variable, it is capped after a certain level. | You get the payment after the house sale either in a lump sum or in monthly payments. |

| No negative equity guarantee is there for the lender. The aim is to offer leave no risk for the borrower. | The property value you get through home reversion is always less than what you get in the open market. |

| Older you are bigger is your mortgage amount. | The value of the property you receive may differ from one provider to the other. |

Before the big decision, you must recall the conditions because every financial solution has some requirements from the applicant. Without qualifying for them, it is not possible to go further and avail the service. Every finance company has to follow specific rules and regulations to maintain a healthy practice in the industry. The best thing is to gain as much knowledge as possible on the initial requirements. Equity release includes several formalities and scrutiny of the financial conditions of the applicant, and they all apply in accordance with the terms and conditions.

Is It Possible To End A Lifetime Mortgage Early?

Yes, it is normal to end your mortgage early, but the cost part can be considerable. It is better to talk to your financial advisor or the mortgage broker. The early repayment charges may apply in case of early payoff.

Usual reasons that people apply for early payment of lifetime mortgage

Generally, people do not pay off lifetime mortgage early. However, if someone wants to do that, there are always precise reasons, and they are –

- A person wants to sell the property

- The person wants to remortgage for a better deal

- Due to availability of a lump sum amount paying off is possible

- One wants to include the home in the will

With the above common reasons, some people make their mind to early pay off the mortgage and fulfil their needs.

Early Repayment Charges May Apply But They ‘May Not’ In The Following Conditions –

The early repayment charges may not apply in the following circumstances –

- When you repay after the age shown in the offer of the loan.

- When you move to a new home and the mortgage is transferred to the new house and for that pay a part of the mortgage.

- In case of joint borrowers and the last surviving of you makes the repayments in the first three years. This should happen after the first borrower dies or moves into long-term care.

- If the index rate is equal or higher than the benchmark rate mentioned in your mortgage offer.

If any of the above situations are related to your conditions, it is possible to pay without any repayments capacity and plan a smooth quit through mortgage payment.

Home Reversion – Is It Necessary To Pay Interest Rate?

No, it is not necessary to pay any interest rate, as home reversion is not a loan. It is an equity release tool to encash the worth of the house that you have already earned. That is like your asset, which can be used to borrow money without any obligation of paying instalments or the interest rates.

The concept of home reversion allows borrowing funds through the sale of the house. What share of the house you want to sell depends on your wish, and no interference from the side of the home reversion provider is there on this decision. However, the home valuation is a vital part of the process to know the current value of the property. To offer a due price of the place, it is a necessary thing.

| Lifetime Mortgage VS Home Reversion | |

|---|---|

| Lifetime mortgages | Home reversion |

| It is a type of mortgage. | It is not a mortgage but an equity release plan through a house sale. |

| You own the house for whole life until the death or shift to permanent or long-term care. | A part of your entire house belongs to the home reversion provider after the sale. |

| To pass the property to a family member, you have to pay off the mortgage entirely. | After the sale of the house, you cannot mention it in the will also, cannot explore the benefits of a rise in the property value. |

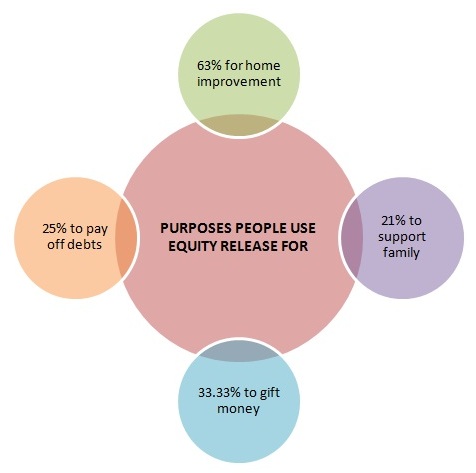

Purposes of equity release

You can turn your equity into cash for varied reasons, but some of the everyday purposes of equity release are –

- Supplement your pension

- Adapt your accommodation

- Manage holiday expenses

- Pay for your daily care

- Pay off mortgage

- Buy an expensive wedding gift

Pros Vs Cons of equity release mortgage

Shine Mortgages believes in transparency and informs about all the related aspects of a mortgage product. Here is an insight into the pros and cons of equity release mortgages. We want to bring you the best equity release options, and for that, we know you should be equipped with the two sides of a coin.

| EQUITY RELEASE MORTGAGES | |

|---|---|

| Pros | Cons |

| Borrow a considerable amount using equity for varied significant financial purposes. | It can reduce the percentage or share that one can leave in inheritance. |

| Tackle your money goals self-dependently without and help from friends and family. | It may affect the eligibility for benefits. |

| Older people can secure their future and can pay for their care. | The borrower has to incur hefty arrangement fees. |

Who can qualify for equity release mortgage?

Several terms and conditions are required to get an equity release. Have a look at them here and see if you can qualify for it. If there is any doubt or confusion, you can always contact us to know the possibility of cash release. With our expert team, we check your financial capacity through equity release calculator and also make you aware of the required improvements in your conditions.

- For a lifetime mortgage, you need to be a minimum of 55 years old. If it is a joint mortgage, the rule applies to both the applicants.

- For a home reversion plan, you should be at least 65 years old and also the partner in mortgage if it borrowed jointly.

- You should have a house in the UK on your name, and that should be your primary residence.

- The worth of your property should be a minimum of £70,000.

- You have only a small or no mortgage amount left on the property.

- The building should be in good condition and suitable to be presented to the lender for borrowing funds.

Shine Mortgages makes every possible effort to offer relatable deals picked sincerely from its large panel of lenders. We make sure that you will always get the most suitable borrowing option and with the fastest speed because we handle all your documentation process.

How To Avoid The Risks Of Equity Release?

Every financial product has some risk factors that you should consider before availing it. Equity release has some similar points, and Shine Mortgages wants to mention here for rational information of its customers. We want you to take a decision only after knowing the varied aspects of equity release.

- If you are applying for a lifetime equity release and want to borrow big, apply with older age than the minimum of 55. It prevents rejection on the asked amount.

- Always avail equity release from the provider who is the member of the equity release. It is the safest way to exploit the value of your property.

- Always talk to either an equity release expert or an equity release mortgage broker before making the final decision.

- In case of any issue, contact your home reversion provider and explain the situation. Your fear can be fake.

Caution is the first condition of the precaution! Decisions that involve a significant amount of money should always have the back up of preventive measures.

Facts About Equity Release

Knowledge of facts always leads to smart financial decisions. If you want to take the maximum from an equity release plan, here are some facts that can help –

- The applicants of the equity release have increased by 6% in the first quarter of 2020.

- The corona pandemic has increased the demand for equity release products.

- The equity release rates are unprecedentedly low, but it is still and expensive option.

- When you avail equity release, an outstanding mortgage or any loan secured against home needs to be cleared.

- Usually, there is an arrangement fee that spans from £1,500-£3,000. The other includes fee types are surveyor fees, legal costs, application fees.

These latest facts and figures can throw light on the path of your equity release plans. One thing is exact that equity release is not a bad deal if you are struggling with financial issues and or seek stability in life. At least, this method lets you borrow funds with self-reliance and no risk. Look at lifetime mortgages, whole life you stay in the house without making repayments. Similarly, the home reversion allows you to get back the earned worth of your house and that too, without any repayments. Isn’t it a great idea? Certainly, it is.

Equity Release OR Downsizing – Which one is better?

It is always tough to make a mind on any decision related to your property. The mind diverts to many options. When it comes to equity release, people want to compare it with alternatives. Downsizing is a usual option that comes in comparison to equity release. People get confused if they should go for equity release or downsizing.

The contrast below can help make a better choice on the suitable option. Shine Mortgages aims to be an unbiased guide on property solutions, and here is another piece of information for convenience.

MEANING

- Equity release – You sell home (partly or fully) and avail funds with no repayments to be paid.

- Downsize – You buy a home of a lower value or price using the equity of the current one.

OWNERSHIP TYPE

- Equity release – You do not own the house because the funds are borrowed through the sale of the home.

- Downsize – You own the home 100% because it is about the purchase of a new house at a lower price.

DO NOT FORGET

- Equity release – The home survey is a vital part of the process of the equity release.

- Downsize – Further costs can be there on the part of home improvements and buying the new furniture.

Ask the following questions to yourself to decide between downsizing and remortgage

The final decision on the importance of downsizing and remortgage can be difficult. If you try to find out the answers to the following questions, it may become convenient to make the mind in the suitable direction.

- For what purpose you need the money?

- How much money is required?

- Do you want to continue to live your home and is it fine to move to a new place?

- What is the suggestion of your family on both the options?

- Which option is more suitable for long-term?

- How immediate you want to get things done?

- Is it really necessary to borrow money, can’t the savings or wise spending fulfil the purpose?

Is it possible to sell a house after equity release?

Yes, a house sale is a practical thing despite the equity release. But it depends on what type of equity release product you are availing. In case of a home reversion plan, it is not possible because you fully or partly sell the house to a home reversion company. The actual possibility is in the case of lifetime mortgages through the full payment of the mortgage.

Financial advice is significant because a shift in your plan may include many types of calculations and budget planning. You may not be able to understand the technicalities of how a change from equity release to the sale of the house works. A financial advisor or mortgage broker can help make precise estimation through equity release calculator. A rational approach is necessary to see if your plans for the future meet the current situations or not.

What is the current rate of interest on equity release?

Currently, the interest rate on equity release is at its lowest level in the last five years. It is 4%, which is applicable to most of the products. Some lenders have a lower offer to provide such as 3.48%, and even lower than this if the applicant has stable and strong finances. At Shine Mortgages, you can compare equity release interest rates offered by the varied finance companies.

Right or Wrong

Multiple conceptions accompany equity release products, some of them are right, and some of them are right. Have a look at them –

You have to pay tax on equity release

You can sell a house after equity release

Equity release industry is not regulated

Equity release reduces the amount you can leave as legacy

Equity release may affect your eligibility for government benefits

Shine Mortgages, like always is committed to delivering the financial relief through best equity release products available in the market. We manage everything for our customers such as - search of the products; once they make a choice, documentation is on us COMPLETELY. You make choices, and we make them work for you in as more straightforward as possible.

FAQs

What happens to equity release on death?

After death, the property gets sold, and the money is used to pay off to the lender.

How much equity can I release?

Usually, you can release 20% to 50% of the property value, besides the factors of your age and building conditions are also important.

How much does the equity release cost?

The rate on equity release products is 3% to 7.5%; what percentage you get depends on your personal conditions.

How long does equity release take?

Typically, it takes 6 to 8 weeks in equity release, and rest depends on the other related factors that count in equity release.