Find a Mortgage Broker in Edinburgh

Edinburgh keeps many possibilities of progress as the capital of Scotland. This hilly, peaceful town is known for its most influential economy in the United Kingdom, and the fact lays a firm ground for property buying in the city. The flourishing economy of this place gives good options for a mortgage advisor in Edinburgh. Here Shine Mortgages would like to present its candidature as a fee-free online broker.

We, as a large panel of 90+ lenders, make lucrative home loan deals available for all sorts of property needs. We are online, and that is why easy to access 24x7 despite bank holidays.

We make sure that none of the fund seekers should bear any compromise on their needs of funds. Through a simple and understandable process, we find relatable options for you. Whatever we bring, it is backed-up with the feature of customisation to facilitate affordable funds. The repayments are friendly to the pockets of the applicants due to lower interest rates. OUR ACTIONS ALWAYS RECIPORATE OUR COMMITMENTS, and we commit to bring to you ONLY ‘THE BEST’.

How to Buy Home in Edinburgh

An organised approach is the first need when you buy a home. A decided process can help you to reach the desired end as well as avoid the maze of confusion. Here is a small step-by-step 'How to' guide on home buying.

- Contact the local agents.

- Tell the location priority.

- Search and visit the property.

- Finalise the property.

- Book the house with a booking fee.

- Find a solicitor to handle legal formalities.

- Find a free broker online to find a lender.

- Once you finalise the lender, apply for a mortgage with all necessary details through the process.

- Arrange home inspection (by you and the lender).

- Once you qualify for the funds, get money and make the final purchase of a home.

Depending on the lender, the process can be a bit different. It is the big picture designed to give you an idea of how things work.

Our Guidance Is For Any Mortgage

Shine Mortgages deals in a wide variety of mortgage products. Around 100 lenders on its panel belong to varied categories of a property loan. These are -

Mortgage for first time buyers

Mortgage for first time buyers Remortgages

Remortgages Mortgages for Bad Credit

Mortgages for Bad Credit Mortgages for moving home

Mortgages for moving home Mortgages for self-employed

Mortgages for self-employed Buy to let Mortgage

Buy to let Mortgage

Mortgage for first time buyers

We bring you friendly and easy-to-qualify mortgage options with 100% LTV deals for first time buyers. With us, you get the following benefits -

- A complete guide on the home buying process to make you familiar with the things

- At least 5 options of interest rates according to your affordability

- Friendly suggestions to help you qualify for a mortgage

Remortgages

Your second experience of the mortgage procedures in the name of remortgage is always smooth with us. We solve all concerns that borrowers usually want to fulfil through it.

We facilitate -

- Better interest rate options to squeeze lessen the total cost

- Round-the-clock assistance to remortgage with the new lender

- Perfect calculation of your loan-to-value ratio

Mortgages for Bad Credit

Poor credit situation always creates mess. Shine Mortgages nullifies all negative factors and help you borrow despite bad credit rating. Our poor credit mortgage service includes -

- Expert advice to suggest practicable ways for improvement of credit score

- Assistance on maintaining the balance of income and outgoing for a smooth approval

- No credit check deals available

Mortgages for moving home

We make your journey to the new home easy and seamless with stress-free loan options. The moving home mortgage has -

- The commitment of providing the lender with the lowest deal

- Easy reach to funds if you need to add more on the existing mortgage to buy a new home

- Best efforts to facilitate fund disbursal in 4 working days

Mortgages for self-employed

It is always challenging to borrow funds for a self-employed. But this is why we sit in the market with the expertise of 15 years. With us you get -

- At least 10 options of home loan

- Lenders with extensive knowledge on types of businesses

- Income sources acceptable if you show annual tax returns, bank statements, profit and loss statements and online transactions

Buy-to-let mortgages

Fulfil your rental income goals with our vast capacity to offer lucrative mortgage alternatives. Our offers provide following convenience -

- More than 15 alternatives with best rates available

- Workable advices on the mortgage to help you get better tax relief

- Bigger borrowing limits

Why choose Shine Mortgages?

As we are rational, we do not ask people to come to us until we give some rational reasons. Here are they -

- Mortgage payment holidays

- Insurance

- Support until you get the funds

Mortgage payment holidays

We have lenders to provide you exclusive and rare chance to take a break from your mortgage payments. You can take a break up to 6 months during which you either do not pay mortgage instalments or pay a minimal amount.

Payment holiday depends on the following factors-

- The lender

- Your financial circumstances

- Your payment history on the same mortgage

- The mortgage contract

Insurance

Shine Mortgages gives you COMPLETE support. We not only bring you deals but also protect you from unforeseen issues that may obstruct your mortgage payments. The unpredictable situations of life may take you in the clutch at any moment. We have a panel of renowned insurers that offer great plans to save your tomorrow.

The types of insurance we provide are

- Life insurance

- Income protection

- Critical illness cover

- Unemployment

Support until you get the funds

Our policies are not conservative or mean in its approach. We do not leave you just after suggesting the mortgage lenders. We stay right there until you get the mortgage money in your bank account. The long conversation that takes place between you and the lender is always backed-up with our presence to prevent any miscommunication.

- Immediate assistance on the phone

- Schedule meeting at your time to clear doubts

- The full responsibility of the deal offered by us

How Does a Mortgage Loan Work?

An infographic is to offer you an outline of the fundamental steps of the mortgage procedure. Keep access to the image handy. Save it in your mobile to know what comes after what for a borrower.

The utility of knowing the mortgage process:

- Get rid of the anxiety that says mortgage process is complicated

- You can know the formalities and documents required

- It is easy to understand the pitfalls that may invite rejection

- The key factors come into your notice

- The trend of the mortgage market in your type of cases becomes familiar to you

- Knowing the procedure is a necessary precondition for any borrower

- It is a good thing to add in your financial literacy.

- Saves time as the start and endpoint is known to you

01

Deposit size is decisive

The minimum percentage of deposit is 5%. However, you can always expand it to a more substantial amount as that affects the mortgage amount.

02

Search for the lender through a broker

Finding a lender with all your concerns on interest rates and repayment plans can be difficult. A broker with an overall knowledge of the mortgage market can bring you suitable options. We can come here to play its role as an online broker.

03

Say ‘Yes’ to a lender

Finalise a lender offered by the broker but forget not to ask all questions to the broking company on the authenticity of the mortgage provider.

04

Follow the formalities

When the process starts, your finances come on the dissection table. Repayment capacity, recent financial behaviour, credit rating, debt-to-income ratio etc. nothing remains untouched from scrutiny.

05

A home inspection takes place

The lenders are always concerned about the property. Its location, proximity to the basic facilities, quality of the used material, future profitability in the property market etc. nothing is avoidable.

06

If approved, get into the loan agreement

After the formalities of taking the financial document and the house report, if the lender approves your loan, sign the loan agreement with uncompromised attention on the terms and conditions.

Apply for a Mortgage Loan in Edinburgh

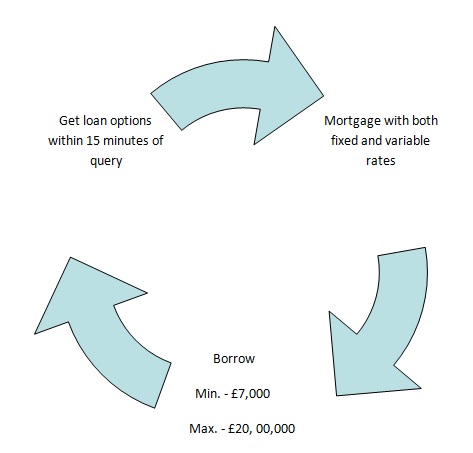

We have a simple three-step process, which makes it easy for you to get closer to your mortgage solution. Here is the sequence –

Visit our website – Shine Mortgages is an online broker, visit the site to get instant mortgage option in a few minutes.

Pick your mortgage type – Once you visit us, select the type of property loan you want assistance for, mortgage, remortgage, buy-to-let etc.

Click on your option – We have three options according to your need of assistance –

Pick whatever you want. In case you select ‘APPLY NOW’ provide the basic financial details, our experts will suggest you the available lenders in just 15 minutes.

Mortgage Features of the Lenders in Our Panel

For no compromise in your experience as a borrower, only the trustworthy mortgage companies get a place to appear through our platform. The basic features that they provide are -

- Customised loan offers - As a mortgage is an expensive commitment, a concern is always there to get the most affordable deal. That can happen only when the loan offer is in accordance with your financial efficiency. Our listed lending companies provide you with tailored choices to make sure that the instalments are not hefty, and the interest rate is not too high.

- Instant approval decision - We know the value of your time and respect it in the right manner by suggesting the choices that have immediate approval decision. Send the application, wait for a few minutes, and the screen shows the message.

- High approval rate - It is intense stress to get rejection as the two essential things, your credit score and confidence come under pressure. We bring the choices that are backed up with 95% to 98% approval rate.

- Borrower-friendly websites - There is no hassle in the use and access of the websites of the home loan companies. We make sure that you land to user-friendly websites that are immediately reactive. Whether you fill a form or leave a query, every action occurs conveniently.

Shine Mortgages serves to not people but to their concerns as that solves the purpose naturally. Buying a home is a beautiful yet challenging decision, and we make sure that you reach the desired result with no hassle. It is not only a commitment but a principle to deliver you the possible mortgage deals. We are quite stubborn when it comes to providing quality to our clients, whether it is an advice or a loan offer that we bring.

Choose any corner of Edinburgh to buy a property, and we promise to assist you there with the most worthy options that are best in the market.

Mortgage Broker Edinburgh FAQS

Which is the best mortgage broker in Edinburgh?

This type of mortgage applies to those individuals who are applying for the home for the very first time. There are a few mortgage providers in the UK present exclusive benefits to them, but the overall mortgage is provided based on their income and spending.

These brokers are known for their quick financial solution and access over 50 lenders dealing in different sorts of mortgages.

Does Mortgage Broker in Edinburgh charge fees?

It mainly depends upon the broker to broker, but a reliable mortgage broker does not charge anything from the borrowers. But they do charge commission from the lenders as they are bringing borrowers for them.

Although some brokers also charge from the borrowers, this is only the arrangement fees with no hidden cost included. If you are looking for a mortgage and have a tight budget, then you should select these independent mortgage advisors.

Can a mortgage broker help with bad credit?

Of course, a mortgage broker does help people with bad credit scores. Most of the credible advising companies in Edinburgh are not reluctant towards the applications with poor credit is mentioned.

They help borrowers to get reliable mortgage deals from trustworthy lenders. Furthermore, they also guide in rebuilding the credit scores by suggesting the best ways. Applying directly from the lenders may not be possible, and the only broker can make it possible for you.

How long should a mortgage broker take?

Technically it depends on the process a broker follows; however, it is usually considered that an expert broker gets things done faster. Have a look –

- Mortgage options on your screen within 15 minutes of making online query by the fund seeker

- One face-to-face meeting(can be done immediately) to explain the mortgage deal you choose

- Once the application is sent, and the loan is approved within 15 working days funds get transferred.

Overall, you can take 20 to 23 days in totality. Some brokers like Shine Mortgages may do it in 15 days.