Advanced debt consolidation mortgage

Fee-free advice round-the-clock

Dedicated relationship managers

What Is a Remortgage For Debt Consolidation?

A debt consolidation mortgage gives you the liberty to refinance your existing mortgage and borrow extra money to pay off other small debts through home equity. The property is used as security. This popular method is usually used to pay off multiple and high-interest debts. The borrower pays only one instalment in place of various repayments, and that is also on a fixed rate. The terms and conditions of the deal change after remortgage according to the changed circumstances.

How does debt consolidation Remortgage work?

The lender does the affordability check to see your payment history. With many missed payments, you get a smaller amount through remortgage. The other two factors are also important to consider, 1) equity on your home and 2) the mortgage amount paid off by the borrower. The third one as you know is the payment history. With all three factors , the lender offers a deal with the amount that you have qualified for.

Other Financial facets that lenders focus on know the eligibility of the borrower

Obviously, your finances come under immediate notice to qualify for this mortgage product. These are –

- Calculation of the home equity on the current property and also its market value

- Detailed credit report obtained from credit reference agencies

- Total number of debts such as applicant may have a total of 5 different loans and credit card debts

- The value of the property and also the percentage of rising in value (if there is any rise)

- Current income status – monthly salary for employed & monthly earning for self-employed

- Recent financial behaviour in terms of debt and bill payments

- Income-outgoing ratio and the scrutiny of spending habits

Shine Mortgages takes care of all the responsibilities for borrowers and its associated lenders.

When the lender is satisfied with the financial part applicant needs to prove affordability

Once the lender is convinced after scrutinizing your finances, it takes your application forward for the following process.

- Affordability check through debt consolidation mortgage calculator

- Asking for a repayment plan from the applicant to know how will he pay the debts

- The detailed study of the debt payment plan submitted by the applicant to check practicability

We help you explain the repayment schedule to the lender and also clear all the related doubts.

What happens once the lender is convinced with everything

This is the last stage where everything takes its final shape in the mortgage deal

- Approval decisions – the applicant gets approved after crossing all the above stages

- The lender offers a refinance deals with the amount and rate the applicant qualified for

- A bargain takes place between the lender and the borrower. This is where we appear again

- We get the deal finalized on an affordable rate and desired repayment plan for the borrower

- Once the borrower gets convinced the title insurance, title search and legal fees apply

- After all the above conditions the borrower gets the funds to pay off the debts

All the above process is not a headache for you because we take care of everything. The procedure is more or less the same in case of all the debt consolidation mortgage providers, and we are working with them since long. We know the factors that make them say ‘YES’ on your application. You need to provide us with the required documents and sit back to relax. Do not worry, we inform you through timely notifications. You get individual attention through our relationship managers.

NOTE – The debt consolidation affects getting mortgage approval because usually, you can borrow up to 65% of your home equity. If the debt is more than that, the acceptance of application can be difficult.

Which mortgage providers allow debt consolidation?

Debt consolidation mortgage is a specialized mortgage product, and not every lender offers it. There are selective names that facilitate this financial product.

Shine Mortgages has several lenders for mortgage refinance debt consolidation on its panel. They offer funds on reasonable rates and plausible repayment plans.

Usually, it is not easy for a mortgage seeker to find a reliable and suitable loan and lender because of less or incomplete knowledge about the mortgage market. But we ensure ease and find a workable mortgage option to help you integrate all your small debts.

Benefits of Remortgage For Debt Consolidation

You invite many benefits when you consolidate debts through remortgage. Here are some of the most common ones.

- Varied monthly instalments merged into one with the mortgage repayments

- Lower rates and small size payments that bring back financial balance

- It becomes easy to qualify for the other financial products like loan and credit cards

- No threat to credit score due to the fear of missed payments or default issue

- Get rid of the debts early by making part payment as there is one only instalment to pay

- Versatile nature as you can also get right to buy mortgage with debt consolidation on your council house

Why choose Shine Mortgages

Shine Mortgages always works for the financial well-being of the borrowers and work on every aspect that can make your access to the mortgage deals easy and uncomplicated.

- Broking services with uncompromised quality without any broker fee

- We have many lenders on the panel with affordable deals and flexible lending policies

- Advanced debt consolidation mortgage refinance calculator for rational decision-making

- We work on bank holidays to provide an unhampered delivery of financial peace

Types of loans you can consolidate through mortgage

The remortgage for debt consolidation encapsulates varied types of loans that are higher in the interest rate and add unnecessary burden to your finances.

- Auto loans

- Student loans

- Credit card loans

- Personal loans

- Payday loans

We always make sure that your experience of the second mortgage for debt consolidation purpose should remain smooth with us. Our dedicated team is still on its toes to bring the desired outcome of unifying sundry obligations into one manageable debt. You can know us better through an interaction. Call us or visit our website and let us know how we can help.

Questions To Ask Before You Remortgage To Pay-off Debt

Before you dig in deep in the mortgage market to find the best debt consolidation mortgage providers, find the answer to several questions. Their consideration is essential because ignorance of some crucial aspects may make you take a wrong borrowing decision.

Question - What should be the idol interest rate?

Why to ask - If you will end up paying more interest rate than what you are paying in other debts in totality, it is vital to find a cheaper rate. For that, you need to find the lender with the best possible quality of interest that does not increase the cost. A mortgage broker can quickly help find the best deals of remortgage to pay off debt.

Question – How much will be the fee?

Why to ask – The fee factor is always important whether you take the first mortgage or take a remortgage to consolidate debts. The fee and charges have a considerable share of the total cost. To keep an estimation, it is necessary to know the fee structure of the remortgage deal.

Question – What will be the new monthly payment?

Why to ask – The prime purpose of debt consolidation is to get rid of the monthly chaos of paying hefty instalments. Now when you are thinking of remortgage to get a smaller monthly repayment, it is necessary to work on this aspect. The remortgage should be friendly to your budget plans; otherwise; it is useless to go through the lengthy process.

Question – Will this improve my situation?

Why to ask - Borrowing more on your mortgage for debt consolidation can help if you improve in the current situation. A remortgage should be capable of bringing a positive change in the current condition of debt management. It should be able to provide a workable solution to the issue of scattered debts. Whether it is about the interest rates, monthly payment or fee structure, the deal should be affordable as well as lucrative.

Question – What type of mortgage is suitable for me? Fixed-rate? Variable-rate? Tracker Rate?

Why to ask – Every type of mortgage has some pros and cons. It has its features that may help you bring considerable relief in your conditions. Compare the types on all the points of contrast and get a rational outcome for a safe decision on your debt consolidation.

The above questions help you clarify the bigger picture and also scrutinize the significance of a debt consolidation mortgage in the UK. A smart person always considers the impact of a financial product on his circumstances. You should do the same to play safely in finances. One wrong selection can spoil your stability, and one right decision can bring back the normalcy.

Conditions You Face While Remortgaging For Debt Consolidation From Other Lender

Remortgaging with another lender exposes you to certain conditions that are not difficult, but they should be under your knowledge.

- You can apply for a smaller amount as compared to the one that you can borrow from your existing lender. However, the prime benefit is visible on the part of the interest rates. To get a new customer, the lenders are always eager to offer a lower rate of interest.

- Monthly repayment tenure can be similar to the existing lender if your payment history with the existing one is spotless with no delayed or missed payments. The strong affordability is also a significant factor to turn the game in favour of a borrower.

- The other lender is always keen to know the loopholes and challenges of your debt management. That becomes the base of approving funds for debt consolidation. The borrowers with situational issues usually get some flexibility from the lenders. But those with careless financial behaviour need to prove their sincerity at the time of the deal.

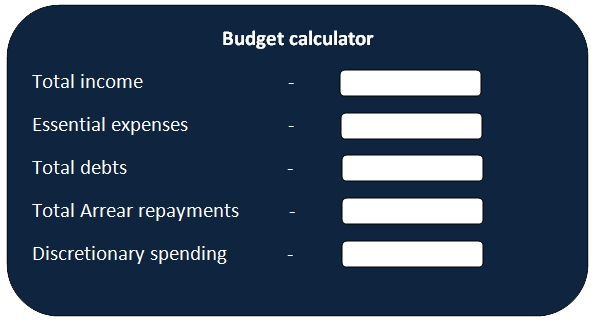

Budget Calculator Helps Describe Your Finances To The Lenders

For obtaining best debt clearing loans through remortgage, your current financial circumstances should be clear to the lender. Besides, it is necessary to have a debt management plan. That becomes the basis of reasons that are presented to the mortgage company to prove the significance of debt consolidation. With the help of a budget calculator, you can easily do that and can win an affordable deal.

Here is a generic format of the budget calculator that Shine Mortgages uses to help is customers calculate their costs.

Explanation of the elements of budget calculator –

- Total income – It is the monthly income you receive through job or business if you are self-employed

- Essential expenses – These are the priority expenses such as council tax, mortgage instalments, rent, school fee, transport etc.

- Total debts – The overall pending debts including loans, credit cards, bills, etc. need to be mentioned here

- Arrear repayments – It is the due payments on debts such as loans, credit cards etc.

- Discretionary spending – The expenses that are not essential but occur on the wish of the borrower such as movie, gym/club membership etc.

Two Factors That Drive The Whole Remortgage Deal

Besides, your financial conditions, the lenders depend on the two prime factors for the final approval decision on your remortgage deal.

- Equity of house

- Mortgage paid off by the borrower

Let us take both one-by-one –

- Equity of house – The maximum money you can borrow on your home through remortgage for debt consolidation depends on its value. The lender arranged the property valuation to know the latest worth of the property in the market. Higher is the equity; bigger can be the amount that you can borrow.

- Mortgage paid off on the current mortgage – Of course, a lender cannot offer you a more significant amount than what you have paid off in the existing mortgage. If you have taken £250,000 as a mortgage, it is vital to show that you have paid off a certain percentage of it. This rule is necessary if you want to borrow a desirable amount.

Both the above two factors decide the significant part of the remortgage debt consolidation deal. Stronger you look at these two aspects, better are the chances a good deal.

Pros And Cons Of Remortgage Debt Consolidation

Remortgage for debt consolidation comes with its own (+) and (-) factors. You can make a better decision if you know both the sides of the coin. Here are the most common pros and cons that usually cross the way of every borrower before the final deal.

|

Pros |

Cons |

|---|---|

|

Consolidate debt and pay off on an affordable rate and in fixed instalments. |

You may not get the best rate if there is any missed or delayed instalment payment in the past. |

|

Gain a considerable rise in credit score and improve creditworthiness. |

Extended loan period increases the total amount you pay on your mortgage and on the interest rates. |

|

Attain financial peace with less number of debts that make the attainment of future goals easy. |

Default in the loan can put your house in the threat of repossession. |

|

Take the benefit of the equity earned on your house without depending on others for any financial help. |

May not be an advisable idea is the debt size if big. |

Myths About The Remortgage For Debt Consolidation

Myths always blur the difference between the right and the wrong. They keep you away from financial well-being and take all the control from your finances. They are hypnotic and make people ignorant of reality. But, their weakness lies in your power of knowledge. If you want to exploit the actual benefits of additional borrowing on the mortgage to clear the debt, get rid of these myths.

- Debt consolidation is complicated – No, it is not complicated. However, you need to follow the complete mortgage procedure. The issue is usually raised by the borrowers who believe it as a cakewalk. They think that it is just a one-day process, and no property valuation or affordability check is included.

- You cannot remortgage with bad credit – We should all know that the finance industry has changed a lot. That change is visible on the part of lending policies towards the poor credit people. It is always possible to consolidate loans through a remortgage with poor credit.

- You always save a lot of money on the interest – It is partly correct and partly wrong. If your debt size is significant, you have to borrow a considerable amount through remortgage. That naturally increases the amount of the total interest you pay on the mortgage deal. In short, sometimes, debt consolidation may not be a good idea if you have made many mistakes in debt management.

- It is extremely time consuming – The process needs to be followed in the right manner. However, that does not mean that the procedure is time consuming. With the emergence of FinTech, most of the lenders have an online application process. Also, the online mortgage brokers make the deal more stress-free and tackle the complete process that saves time of the borrower.

Myths are hazardous for the financial well-being of you and your family. They drive wrong conclusions and create hallucinations that lead to bigger chaos and destruction in financial life. Before you lose money and confidence due to any myth, read the above points and stay safe.

How To Compare Remortgage Deals For Debt Consolidation

Specific rules ensure a safe and smart comparison between the remortgage debt consolidation companies. They all drive you towards the fulfilment of purposes behind the consolidation loans.

Following the following rules while you compare the deals offered by the varied lenders –

- Self-educate with thorough research

Research helps in making a rational comparison when you remortgage the house to pay off debts. It is not bad to take suggestion and guidance from others in your financial decisions. However, it is also not fair to depend on others after a certain limit. Before you decide on what others say, do in-depth research of the market. Get to know the popular terms used in the industry to describe the remortgage products for debt consolidation. Read as much as you can about the product and also get deep into the reviews, they reflect the real situations that you may go through.

- Do not act as a one many army, take some professional help

This rule is indeed a contradiction to the one mentioned above. However, it is necessary to create a balance. Comparison demands good knowledge about mortgage options. It is fair not to take every work on your shoulders. When it comes to financial issues, decisions demand perfection. Either take some advice from your financial advisor, or hire a mortgage broker, get anyone who can help you better with no or little cost. Shine Mortgages is a fee-free online mortgage broker if you need one.

- Ask questions to the lenders; their answers give grounds of comparison

Never hesitate to ask questions. More questions you ask from the lenders, more clarity you earn about the debt consolidation companies in the UK. The answers obtained from the varied lenders help in making a comparison. Their response on the policies for the interest rates, repayment plans, fee structure etc. will give sharp clarity to you on what is the most suitable thing for you.

The above points are the pillars of comparison to know what is best for you. You may be looking for Natwest debt consolidation loans, but in conclusion, the Barclays option may emerge as the better choice. Keep your calm and give complete time to your concerns; nothing in haste gives desired results. Stay rational, and you can always compare better with a clear mind.

Shine Mortgage is dedicated to offer customer-friendly service on remortgage for debt consolidation. We find the best suitable lender for you through our whole of market approach. Before everything, we educate on the nature and features of the varied available mortgage options. We aim to bring you the complete solutions, and for that your awareness of every aspect is necessary.

Debt Consolidation Remortgage FAQs

Can you consolidate debt into a mortgage?

Yes, you can go through the debt consolidation mortgage products available in the market on cheap rates through your home equity. Shine Mortgages can ensure your access to those loan options and can help bring a positively drastic change in your current financial situation.

What is the smartest way to consolidate debt?

The smartest can be only one and ‘mortgage for debt consolidation’ is the best way for this purpose. It helps you get rid of multiple debts in a short time. However, a significant fact is that you can borrow up to 65% of home equity.

Is consolidating debt into mortgage a good idea?

Yes, it is always a good idea. After all, you can manage debts on a lower rate and through single instalment. You can attain back the lost balance of monthly budget without any compromise in the desires.

Can I remortgage to pay off debt?

Yes, you can. A remortgage is the prime way to pay off debts quickly through debt consolidation in your current mortgage deal. There are good deals available in the market that can solve this purpose efficiently. A broker can help you find the right option quickly.