What is a 5-year fixed-rate mortgage?

A 5 year fixed rate mortgage denotes to the situation in which a property loan stays under the effect of a static rate. After these 5 years, the mortgage becomes impressionable as the interest rates change according to the base rate issued by the Bank of England. After that, the standard variable rate will apply until the end of the tenure. In that case, the borrower can only ask your lender to offer a rate of interest nearest to the base rate as that is less expensive. However, the policies of the lender and the payment records of the borrower are the two principal elements that decide the final rate.

A precise example can explain the concept better – You want to borrow £300,000 through the 5 years fixed rate method. The offered rate (after considering the financial condition of the applicant) by the lender is 2.50%. Once you get approved, for the first five years of the tenure, the interest rate will be 2.50% only. During the set time whatever change comes in the bank rate, it will not be applicable on the mortgage.

The total interest that you will have to pay during the five-year tenure is = £12.968.33 and full repayment will be £212,968.33, which are the principal + interest.

How do these loans work?

These loans work in the decided manner followed by the mortgage industry with the following facets as the part of their fundamental nature.

- The borrower gets a fixed rate according to its financial capacity to repay the funds and the debt-to-income ratio.

- The applied rate decides the monthly instalment that is a mix of interest + principal amount remains same.

- Any rise or fall in the bank rate will not be applicable during the fixed time.

It is the essential nature of the fixed-rate mortgages; the period of static interest is different. It is mostly 3 years, 4 years or 7 years.

How to pick the right 5-year fixed mortgage rate

Selection of 5 years fixed mortgage rate depends on varied factors. No single facet can act decisively as many others are equally influential. Shine Mortgages helps you smoothen to all the ups and downs and find a lender that matches well to your circumstances and financial needs. To know exactly how things work, pay heed to the following points.

- Your payment history, credit score performance, location of property and size of the deposit are the vital elements that primarily affect the final deal and its rate. Good credit score, flawless repayment record and big size down payment (more than minimum 5%) are the significant factors that help to drive the deal in your favour with a desired fixed rate.

- Read all the terms and conditions mentioned by the lender, carefully. It is essential to read between the lines to detect anything that may create an issue later. However, ShineMortgages is well aware of the strategies and policies of all the lenders on its panel. We just expect you to act cautiously on your part.

- Know about all the charges and processing fee beforehand, as these things affect the total cost of the mortgage. Compare all the deals we bring to you and pick the one that is most lucrative in terms of overall value.

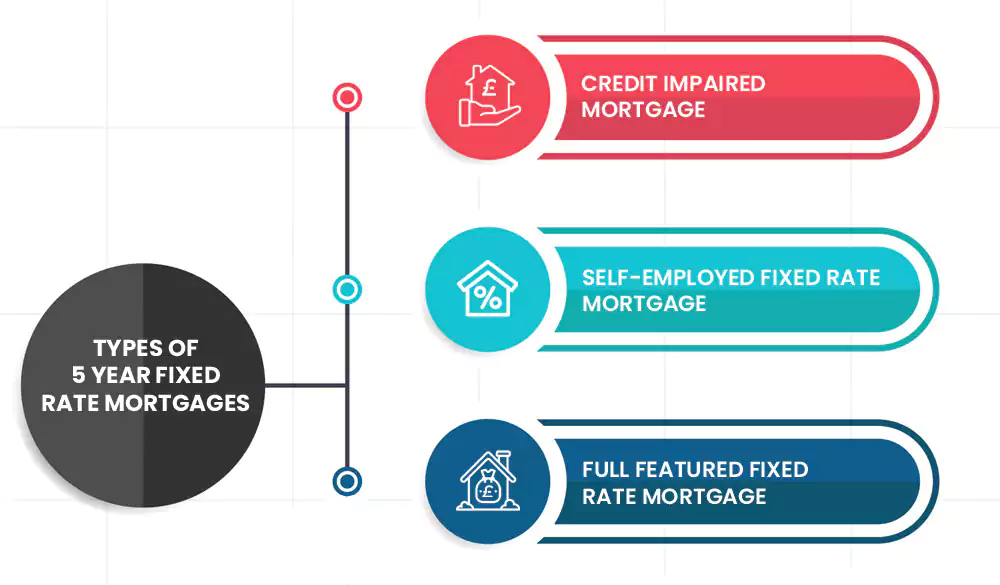

What are the types of 5 year fixed rate mortgages on offer?

Several types of mortgage options are available and knowing them can help you choose the one that is convenient and pocket-friendly.

- Credit impaired mortgage – This is for the bad credit score people. Unlike other property loans, it offers competitive rates and customised repayments schedule to the applicants with derailed payment records.

- Self-employed fixed rate mortgage – The set of conditions that apply to this type is a little complicated if the lender fails to understand the kind of business. Unlike the other self-employed loans, for this mortgage, the applicant needs to show the accounts of the latest 3 years. In different types of mortgages, the details of 2 years are sufficient.

- Full featured fixed rate mortgage – This contains a range of features that make the borrowing smooth due to various facilities. However, these deals often include a higher fee.

The best things that come with this mortgage are –

- Instant approval decision

- Mortgage insurance

- Part payments

- No prepayment penalty

- Flexible repayment plans

How to Get a 5 Year Fixed Rate Mortgage with a Bad Credit History

It can be challenging to get approved for a mortgage with bad credit history as mostly the lenders act reluctant towards the applicants with poor payment records. The high-risk factor for the lender can dominate the chances of acceptance. However, practical problems have practical solutions, and Shine Mortgages proves that by acting as a perfect platform to obtain the right collection of deals.

Here is how we help you get the approval:

- We offer the best possible assistance to people with poor credit history. Contact us 24x7 and tell us about your financial situation. We will scrutinise your income statement and financial stability to bring you the most affordable mortgage options finally. Due to the bad credit situation, you may need to pay a bit higher yet reasonable interest rate as compared to the good credit score buyers. Our experts invest uncompromised efforts to deliver you best experience.

- People with good credit rating may get a lower mortgage rate if they submit the minimum amount of deposit required. However, in the case of poor credit rating, the deposit amount may go up to 20%. More significant the down payment, lower the rate of interest.

Here we suggest some ways that you can follow to earn a boost in your credit rating:

- Pay Bills on time

Did you know even a few late payments can pull your score? Timely payment of bills is a vital thing to achieve improvement in your financial situation. - Be Consistent

The habit of consistent repayments of debts and utility expenses is another vital thing to ensure a speedy escape from poor credit situation. - Contact Your Lender

Your lender can always suggest better alternative repayment plans if you struggle to make your ends meet.

What is the current 5 years fixed mortgage rate?

The fact is that the fixed mortgage rate offered by varied lenders is always different. The lenders decide that according to the percentage of LTV they take. To give you a precise idea if a lender is taking the LTV of 75%, it can take up to 2.5% fixed rate. Besides, it is wise not to forget the fact that your repayment capacity is also a significant factor in calculating a final figure. Shine Mortgages gives its best to bring the minimum rate with maximum LTV.

Features of a 5-year fixed-rate mortgage

When you know the elements of a mortgage product, it becomes easy to take the big decision. Here are those that relate with a 5-year fixed mortgage.

- Unchanged rates –

You pay a decided price for the time of 5 years, and any change in the market trend or economic conditions of the country cannot affect it until the number of years is over. - Every month same payment –

As the interest remains same the instalment amount too remains the same until the fixed-rate period gets over. - More part of an instalment is interest –

The instalments that you pay during the fixed year time majorly covers the interest part of the mortgage. After that, the principal amount is covered through the repayments during the rest of the tenure. - Affected by LTV –

The fixed rate is always affected by the LTV offered by a lender. To get the right balance of desired LTV and rate of interest, you need to approach a broker. ShineMortgages solves this purpose precisely with its fee-free broking services.

Do they charge hidden fees?

To be precise and straightforward, No!. ShineMortgages finds out only those mortgage lenders in the UK, which charge no hidden fees. For transparency, we provide customer care support to ensure that all of your doubts and queries are resolved. Still, we suggest you ask the lender about the hidden or upfront fees while you compare the options offered by us. We do not have mortgage lenders on our panel that charge hefty hidden fees. Under the guidance of our experts, you will only choose the best deal.

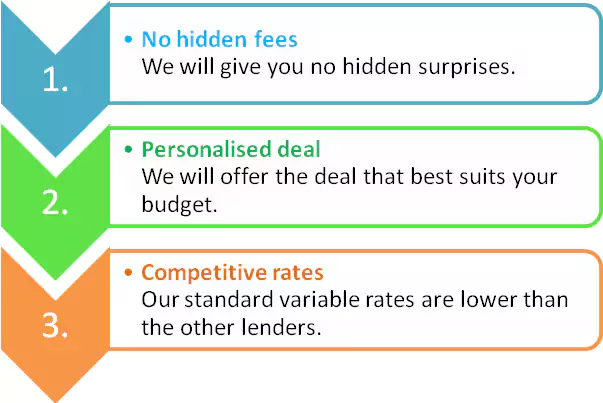

Three features of fixed-rate mortgage deal that our lenders’ panel can vouch for:

- No Hidden Fees

Lenders selected by us never give you hidden surprises - Personalised Deal

Get the deals that best suit your budget and financial efficiency - Competitive Rates

The standard variable rates that you get from our lenders after the fixed term is over are lower than the other options in the market

Can I pay interest only?

Yes, you can, but for that, you need to change the type of deal from fixed rate to interest-only mortgage through a remortgage. However, you need to discuss this with your lender. In case, you face any difficulty; ShineMortgages is always there to assist you to switch to a new method of the mortgage. We are still available for the existing as well as the new borrowers. To switch to the interest-only mortgage, you need to make sure that you pay the instalments of the current mortgage deal on time. Otherwise, the lender may act reluctant.

Can I pay my interest in advance?

Yes, you can pay your interest in advance, but for that, your mortgage provider must have that feature in its product.

Some conditions apply in this concern:

- Several lenders allow paying interest only after you pass a specified duration in tenure. For example – some may not let you do that before the first 12 months.

- Some mortgage companies scrutinise your payment record on the current mortgage to see that you have paid on time, and there is no late fee or penalty that is pending.

Benefits -

2 important benefits are there to make you realise the importance of prepaying your interest in advance.

Tax deduction

Paying interest in advance not only lightens the burden of obligation but also helps on the tax part. It deducts from tax; however, not in all types of mortgages, it is possible.

Paying interest -

- Is tax deductible in case of buy-to-let mortgages

- Is not tax-deductible in case of residential mortgage

The instalments hugely shrink in size

A big part of the instalments contains interest. When you pay off the interest in advance, the monthly repayments become smaller in size, leaving a big space for your budget. It also improves your debt-to-income ratio.

What happens at the end of a 5 year fixed mortgage rate?

When the fixed-rate period of 5 years gets over, the mortgage deal naturally gets under the effect of a standard variable rate that is affected by the base rate. At that time, according to your payment history and the interest rate policy of the lender, a variable rate applies. However, now your mortgage becomes prone to every rise and fall in the interest rates prevalent in the market.

Pros and cons of a 5-year fixed-rate mortgage

A coin always has two sides. Pros and Cons of a 5 years fixed rate mortgage are just like that to facilitate better decision making.

Pros

- You pay the same amount each month

- Income-outgoing balance is easy to maintain.

- No worry on the fluctuation of rates as it happens in the case of variable rates

- With fixed instalments, you can plan part payments to lighten the mortgage burden.

Cons

- There interest rates on these mortgages are higher than the variable rate options.

- You miss exploiting the benefit of any rise in the base rate during those fixed 5 years.

- Your instalments include a tiny amount of principal.

- Its challenging to qualify for a fixed-rate mortgage as the lenders have to bear the loss if the rates go high.

Example – The current base rate is 0.25% in the UK, if it increases to 0.77% then the lender cannot get the benefit of this increase just as the loan provider of a variable rate.

FAQs

Can I take fixed rate home loan for 5 years?

Yes, you can take the fixed-rate home loan for 5 years, but for that, you need to prove a strong repayment capacity against the amount you want to borrow.

- Pay attention to your debt-to-income ratio and try to keep it at 80:20.

- Also, do not take any new loan.

- A Credit score is also an essential factor

Are mortgage rates going down in 2020?

No, not precisely, despite the fall in the base rate from 0.75% to 0.25%, several lenders have not applied the fall in their mortgage rates. It has sent many borrowers in ‘no benefit’ zone. The property market is down due to the after-effects of Brexit. Now Corona chaos and thus the lenders want to cover their loss and lessen the threat of risk.

Is it better to get a 5 year fixed rate mortgage?

Yes, it is undoubtedly better because every mortgage product solves some concerns of the borrowers. Those who want to have a fixed monthly instalment with no worry of rate fluctuations in the market should always consider this. Their smaller repayments do not let the people lose control from their personal finances.