As the Brexit has started taking a toll on the UK’s real estate market, there comes good news for the mortgage buyers. Almost all the prominent lenders have cut mortgage loans’ rates to give the kick-start for the 2nd half of 2019.

High street mortgage lenders including Santander, Barclays, Halifax, and TSB have cut the interest rate of the mortgage loans. Sensing the possibility of a business shift to large players, the relatively smaller players of mortgage lending like Post Office Money, Virgin Money, and Coventry Building Society also slashed down the interest rate.

The margin gap between the average two years fixed mortgage interest rate at 95% and average 90% loan-to-value (LTV) is at the minimum level since February 2013; it points out the reduced pressure over the borrowers for having high LTV band. At present, the margin between the max 90% LTV average rate and max 95% LTV average rate is minimum that puts the lenders at higher risk but the intensifying trade competition is forcing the lenders to take the risk for getting new mortgage buyers.

It is a good time for the first time mortgage buyers and buy to let mortgage buyers who can deposit just 5% of property value. According to Darren Cook, finance expert at Moneyfacts, “Lenders are sacrificing part of margin despite higher risk just to compete. The administration and funding administration expenses are almost constant irrespective to different LTV values. Higher LTV mortgages have higher default potential also. It means lenders are sacrificing these margins willingly.”

Although mortgage loan rate drop has brightened the prospects of buying own property in the UK for the first time mortgage buyers also, still, there are many loops that they have to jump for qualifying for a mortgage loan. Since the financial crisis in 2008, the Financial Conduct Authority is regularly introducing new affordability checks that mortgage lenders have to follow; therefore, the required changes are being made in the respective online mortgage calculator. The most changed mortgage calculators are first-time buyer mortgage calculators; may it be Halifax mortgage calculator, Nationwide mortgage calculator, Moneysavingexpert mortgage calculator, Natwest mortgage calculator, Bank of Scotland mortgage calculator or Lloyds bank mortgage calculator.

“How much can be afforded and how much can be borrowed” are the two very common queries for the first time buyer. The advanced first-time buyer mortgage calculator is available with added features to let the buyers do analyze how much can be borrowed, compare the monthly installment, check the best-suited interest rates by varying the repayment period.

As the competition in the mortgage lending market is getting intense because of dropped property rate, the application procedure for a mortgage deal is also being simplified to eliminate the need of hiring a broker. The leading mortgage lenders like Halifax (mortgaging as a dedicated division of Bank of Scotland), Lloyds bank and Shine Mortgages, etc provide online assistance to help the first time mortgage buyers.

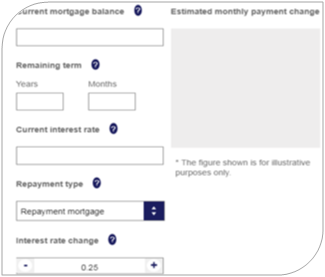

The advanced mortgage calculators facilitate to view the best possible deals available at the particular lending agency. The mortgage cost can be adjusted for affordable limits by varying property value, deposit n mortgage term. The maximum mortgage loan availability can be checked by filling the authentic figures like annual income, a number of dependants, other annual income, numbers of applicants, monthly repayments, mortgage term, etc.

Because of the possibility of interest rate changes in future also, the leading mortgage lenders have started providing rate change calculator also to give the applicants fair idea about the possible changes on monthly payouts with the particular rate change. It is mandatory that the mortgage users should be informed about any changes in a rate change.

As the UK’s mortgage market doesn’t seem very blooming for the lenders, it is the best time for the first time mortgage buyers to take advantage of flexible deals and lower interest rate. The numbers of mortgage lenders have started to advertise for bad credit mortgage also; however, the proposed interest rate is comparatively higher. The average mortgage loan period varies from 10 – 25 years; it is enough period to improve the credit score by saving more and paying on time.

The financial experts in the UK advice to choose the proper mortgage loan category out of ever-expanding options like commercial mortgage, residential mortgage, mortgage for bad credit, mortgage for moving house, mortgage for self-employed and buy to let mortgage, etc; each category leads the borrowers to a particular mortgage calculator that gives best estimates and possibilities.

Regulatory taxes and consistent tax changes have reduced the confidence of buy-to-let mortgage buyers resulting in subdued property purchase activities. The downtrend is expected to continue for a couple of years unless Brexit is settled. The first-time buyers are seen more active after 2017. Numbers of first-time homeowners increased 8% in May 2018 but the mortgage dropped 10%. The outstanding total residential mortgage loan was £1,442 billion in January 2019, 3.3% higher than the previous year; the data shows numbers of mortgage buyers facing problem in repaying the dues.

The UK mortgage market is unlikely to witness significant changes in the 2nd half of 2019 also because of weakening sales activities. It is expected that overall mortgage sales volume will be 5% less in 2019 than in 2018. The leading mortgage lenders provide an online first-time buyer mortgage calculator to help the mortgage buyers accept only the affordable deal. In addition, mortgage lenders have softened the approval approach that resulted in a higher approval rate.

Molly Harris, the professional loan officer and author having more than a decade of experience in her career. She has the passion of solving the problem of those who are looking for the best mortgage while visiting Shinemortgages. She works hard while searching for the best loan solutions tailored to her clients’ financial goals. From first-time home buyers to seasoned investors, Molly’s expertise and dedication cannot match anyone. One can read her research-based blogs here and get the proper guidance. Molly Harris has possessed Master’s degree in Finance field and currently pursuing doctorate research on the UK mortgage.